Absolutely not.

They say if you encounter a bear, you should never run away; rather stand your ground and stay calm.1 The same is true for a bear market. While it may be scary, panicking and running is not your best option. Investors who withdraw their money from the stock market may miss some of the decline, but they also risk missing the recovery and gains that historically follow a bear market.

The Risk of Running Away

Peter Lynch once stated, “Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.”2 In other words, there is more risk in withdrawing from the market and not reinvesting in time to participate in recovery and expansion than the risk in experiencing the downturn and temporary loss. Those who take their money out of the market during tough times run a huge risk of missing the gains when times turnaround.

Pulling investments out of the market when things look bad is an attempt to time the market, preserving assets from the decline and waiting for the rise to get back in. A great man once said, “The best market timer I ever knew was right once in a row.”3 However, market timers must be right twice in a row to profit. Even if you had pulled all your money out of the market the day before the bear market started, the question would be when to get back in. There is no way to know, making it probable that you will miss future gains and be worse off in the long run.

Where Are We Now and What Happens Next?

This year, the market dropped about 25% hitting its lowest point in mid-June. There is no telling if that point was the bottom or if it will suddenly drop lower. While the uncertainty may be unnerving, historically, all bear markets have been followed by not only full recovery, but a bull market.

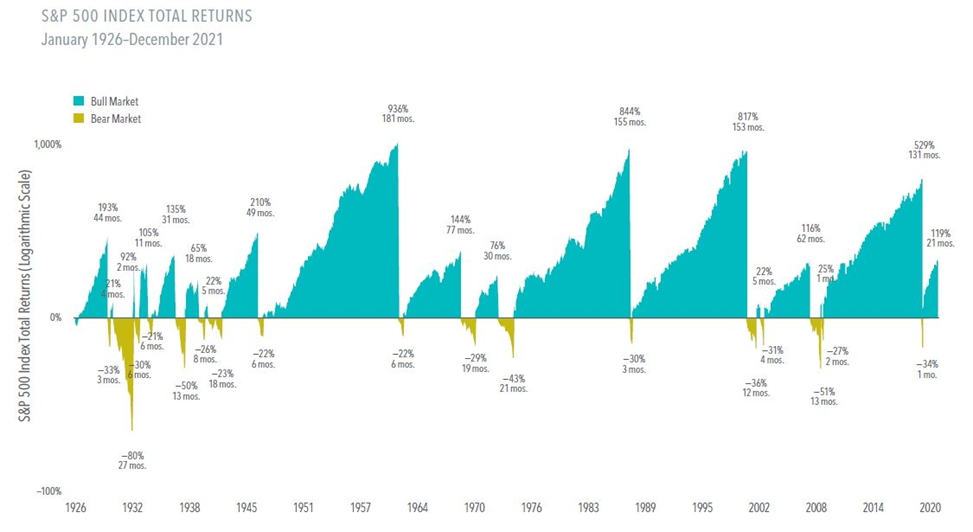

The graph below, provided by DFA Funds, shows a century of bull and bear markets, and, though stock returns can be volatile, the important thing to take away from the graph is that the good times have outshined the bad times, significantly. You will notice the dips which are the bear markets but notice the significant highs and the length of the bull markets that follow.

(Picture: “Bulls, Bears, and the Long-Term Benefits of Stock Investing.” Dimensional. December 2021.)

If we review the last 14 bear markets, since 1947, recovery usually begins within 12 months of the start of the bear market. Even though the year contained a bear market, stocks ended the year a median of 8% higher from when the bear market began. One year after a bear market began, stocks were up a median of 22%.4

History, though the best indicator of future performance, is no guarantee, and we cannot be sure that this market will turn around this year. In several instances, like 2001 and 2008 recessions, markets did take three years or longer to rebound. This is why we use a five to seven-year liquidity plan in our retired client’s portfolios. This gives plenty of time for the market to recover without the need for panic or selling stocks while they are down.

The ups and downs of the market may be unpredictable, but history is on your side and history supports the expectation of positive returns over the long term. Therefore, having patience and staying the course is the key to getting through this market. Remember, never run from a bear.

1 “Bear Safety Tips.” 2018 https://bearwise.org/bear-safety-tips/bear-encounter/

2 “Ten Quotes to Get You Through a Stock Market Correction.” Zurcher, Adam. January 26, 2022.

3 Jim credits this quote to John Templeton. However, we could not find evidence of this. Jim may have made it up.

4 “A Brief History of US Bear Markets.” Kolakowski, Mark. June 16, 2022. Investopedia